Creating a budget is an essential step in managing your finances effectively. It helps you track your income and expenses, plan for the future, and achieve your financial goals. However, creating a budget from scratch can be overwhelming. That’s where a budget planning template comes in handy.

A budget planning template is a pre-designed spreadsheet or document that helps you organize your finances and track your spending. It provides a structured format for recording your income, expenses, savings, and financial goals. Using a template can save you time and effort, and make the budgeting process more manageable.

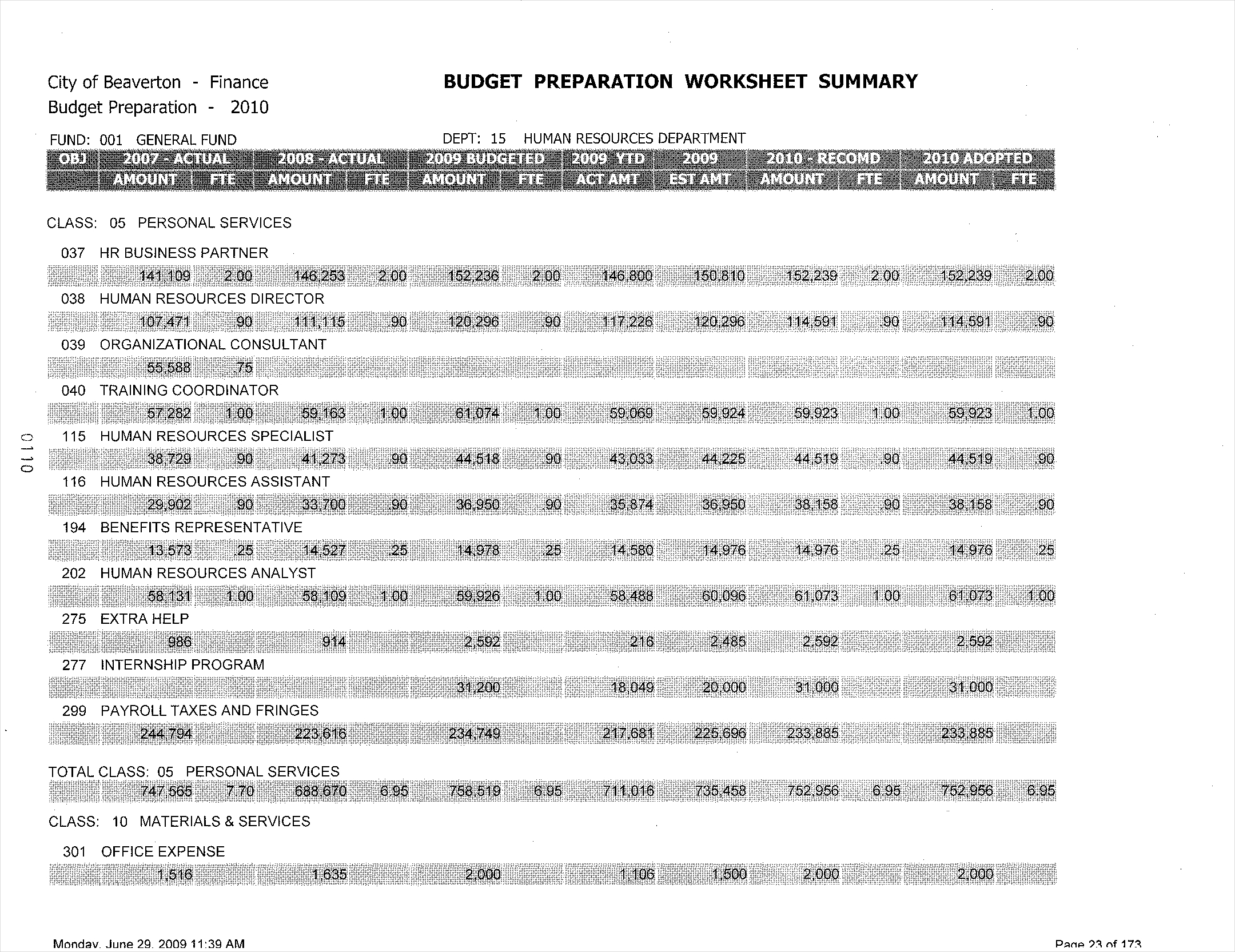

Here is a basic template for budget planning:

Income

List all sources of income, such as salary, bonuses, and investments. Calculate your total monthly income.

Expenses

Break down your expenses into categories, such as housing, transportation, groceries, and entertainment. Track your spending in each category and calculate your total monthly expenses.

Savings

Determine how much you want to save each month and set aside a portion of your income for savings. This can include emergency funds, retirement savings, and other financial goals.

Financial Goals

List your short-term and long-term financial goals, such as paying off debt, buying a house, or saving for a vacation. Set specific targets and timelines for achieving each goal.

By using this template for budget planning, you can gain a clearer picture of your financial situation, identify areas where you can cut back on spending, and work towards achieving your financial goals. Remember to review and update your budget regularly to ensure it remains relevant and effective.

In conclusion, a budget planning template is a valuable tool for managing your finances and achieving financial stability. Whether you are new to budgeting or looking to improve your current budgeting process, using a template can help you stay organized and focused on your financial goals.