When it comes to managing employee expenses, having a clear and concise credit card agreement in place is essential. This document outlines the terms and conditions that both the employer and employee must adhere to when using a company credit card. To make this process easier, a printable employee credit card agreement template can be a valuable tool.

By using a printable template, employers can easily customize the agreement to suit the specific needs of their organization. This ensures that all relevant information is included and that both parties are clear on their responsibilities. Having a template also saves time and effort in creating a new agreement from scratch.

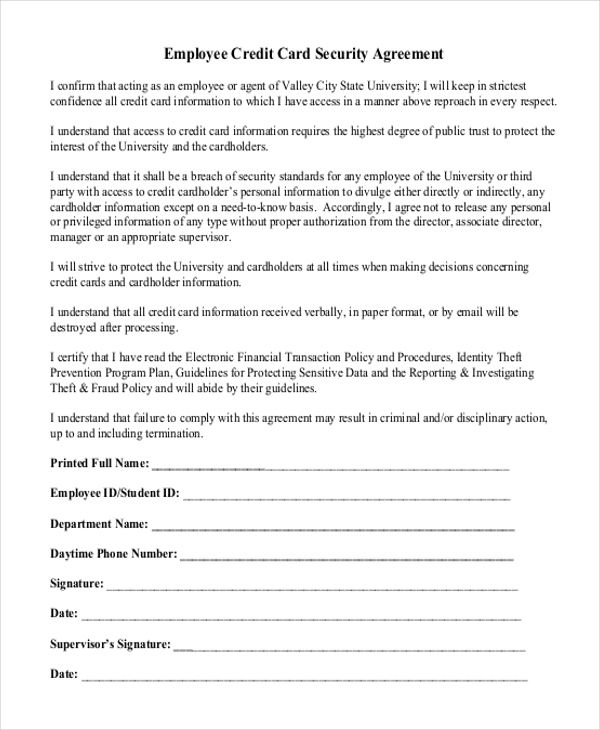

Printable Employee Credit Card Agreement Template

The employee credit card agreement template typically includes sections such as card usage guidelines, spending limits, reimbursement procedures, and consequences for misuse. It is important to clearly outline the expectations for card use, as well as the consequences for violating the agreement.

Additionally, the template should specify how expenses will be reconciled and reimbursed, including any required documentation. This helps to streamline the expense reporting process and ensures that employees are promptly reimbursed for any approved expenses.

Employers may also choose to include clauses regarding card security measures, such as reporting lost or stolen cards and safeguarding card information. This helps to protect the company from potential fraud or misuse of the card by unauthorized individuals.

Overall, a printable employee credit card agreement template is a valuable resource for employers looking to establish clear guidelines for the use of company credit cards. By customizing the template to fit their specific needs, employers can ensure that both parties understand their responsibilities and that the company’s finances are protected.

In conclusion, using a printable employee credit card agreement template can help streamline the process of creating and implementing a credit card policy within an organization. By clearly outlining expectations and consequences, employers can ensure that company funds are used responsibly and that employees are aware of their obligations when using a company credit card.